how to do tax relief

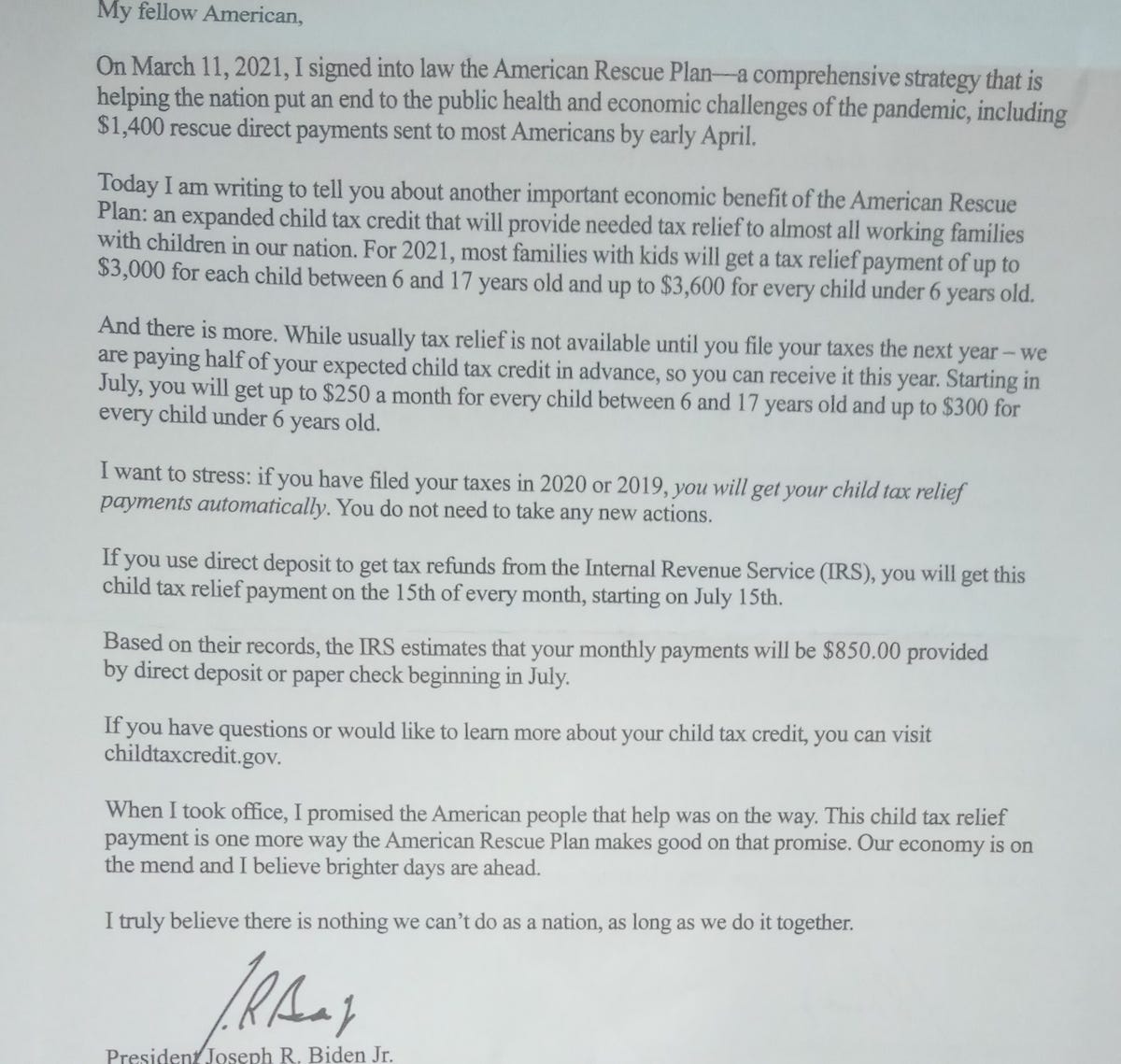

6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra. To receive the 2022 one-time tax rebate of 250 for single filers and 500 for joint filers you must have had a tax liability for tax year 2021 and you must file your taxes by Nov.

All 29 Tax Relief Articles Thecreditreview

In this article we want to tell the story of how.

. Tax relief can get real complicated real fast and how much you hand over to the IRS is going to depend a lot on how well you file your back taxes and fill out relief forms. How much you can claim. Therefore since you dont pay taxes on the 15 of your income you use.

How Do Tax Relief Companies Work. Example If you spent 60 and pay tax at a rate of 20 in that year the tax relief you can claim is 12. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

15 hours agoThe IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located. The Internal Revenue Service IRS offers special tax help to individuals and businesses hurt by a major disaster or emergency. Tax Relief in Disaster Situations.

Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 were eligible for an 850 direct relief payment this year. To be eligible youll need to be. Read through the eligibility.

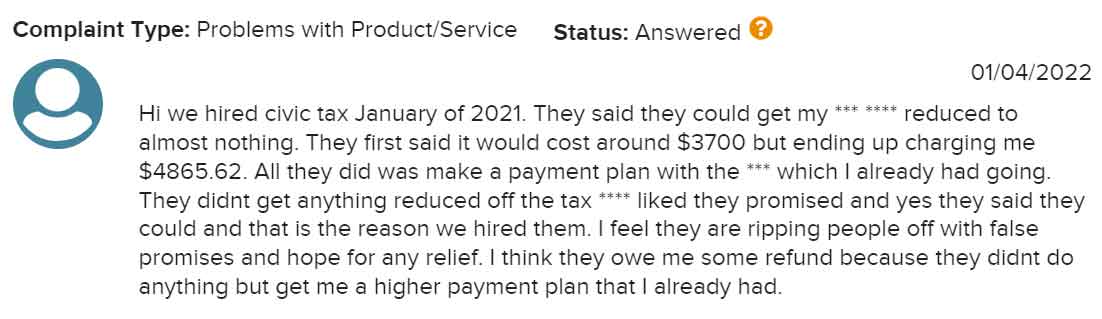

If you pay them an upfront fee which can be. You can either claim tax relief on. Call for a free consultation Tax relief companies use the radio television and the internet to advertise help for taxpayers in distress.

Here are a few things to know about getting tax relief via an IRS payment plan. Settling tax debts with the IRS isnt easy but it isnt a scam. Those accrue until your balance.

14 hours agoAn estimated 9 to 10 million people are eligible but have yet to file their taxes to receive relief. So if you earn 300 a week and pay 5 15 of pension contributions you only pay payroll taxes of 285. Local governments often make the application and instructions available on their websites.

A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment. How do tax debt relief companies work. Please visit our State of Emergency Tax Relief page for additional information.

The checks are part of a 17 billion relief package that also suspended the states sales tax on diesel fuel and provided additional aid to help people with rent and utility bills the. The truth about getting IRS tax relief on your back taxes lies somewhere in between. A payment plan doesnt get you out of interest and penalties for late payments.

You could be eligible to receive payments from a total of three rounds of. The tax relief sector is made up of companies that provide advice and representation to taxpayers who want to settle their tax. Youll get tax relief based on what youve spent and the rate at which you pay tax.

To find out more click on the different reliefs below. Minimum 21 years old Verifiable income Minimum debt must be 5000 What are they able to assist you with. Taxpayers should do their due diligence on any tax relief company by reviewing its credentials and track record before moving forward.

The very first payments. Here are the different ways CuraDebt can aid. 1 day agoNEXSTAR California has started sending out the Middle Class Tax Refund a one-time direct payment meant to help ease the pain from rising inflation.

Get an application and check the requirements. You must complete and submit some documents to the IRS. Besides the application forms and protocols you must include 205 as an application fee and your primary.

5 Best Tax Relief Companies Of 2022 Consumersadvocate Org

Tax Relief And Resolution Services Marietta Ga Tax Relief

Property Tax Relief Options Wayland Ma

What Startups Can Learn From Tax Relief Ppc Campaigns

Tax Relief 801 676 5506 Free Irs And State Tax Consultation

Editorial Hide And Seek Tax Relief State Can Do Better Editorial Nptelegraph Com

Clear Start Tax Relief Clearstarttax Twitter

Tax Relief Program Guide For 2021 Tax Attorney Explains Your Options With Free Guides And Forms Youtube

Didn T Get Your Nys Family Tax Rebate Here S What You Can Do Wbfo

2022 State Tax Reform State Tax Relief Rebate Checks

How Do I Claim The Recovery Rebate Credit On My Tax Return

How To Claim A Hurricane Loss On Your Tax Return Forbes Advisor

Closing Costs That Are And Aren T Tax Deductible Lendingtree

What To Know About How Covid 19 Pandemic Changed Tax Laws

Tax Relief And Resolution The Ultimate Guide To Paying Less To The Irs Starting Melnik Steven V 9780991365708 Amazon Com Books

Town County Property Tax Relief 2020 Town Of Ossining New York

Top Workplaces 2020 Optima Tax Relief Turns Upside Down Right Side For Staff Orange County Register