tax avoidance vs tax evasion hmrc

HMRC define a tax avoidance. From 2018 to 2019 HMRC secured a record 341 billion in additional tax through activity tackling tax avoidance evasion and non-compliance.

Difference Between Tax Planning And Tax Avoidance Finerva

In fact HMRC you should be making tax clearer and simpler so that avoidance is easier and fairer for all.

. When tax avoidance strays into illegal territory it becomes tax evasion. Tax evaders are bad for the economy and are generally sticking their fingers up at society. Tax avoidance vs tax evasion whats the difference.

Avoiding over 25000 in tax is a criminal offence and not only will you go to jail but HMRC may name and shame you if youve evaded more than 25000 in taxes. Genuine mistakes on a tax return such as misculautions and missed deadlines can also be considered tax avoidance. The topic of tax evasion vs tax avoidance is popular amongst both tax payers and accountants but what is the difference between the two.

It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. 01442 795 200. Its not always easy.

This can have an impact on the reputation of your business and sales as a result. There is a fine line between avoidance and evasion. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway.

The penalties for tax evasion can vary depending on how aggressive the tax evasion was the amount of tax that was evaded and the amount of time it had gone on for. The topic of tax evasion vs tax avoidance is popular amongst both tax payers and accountants but what is the difference between the two. But what is the difference between the two.

Other types of tax avoidance or tax evasion Theres a different way to report suspicious HMRC emails text messages and phone calls benefit fraud. Our message is simple come forward and settle your affairs play by the rules or be caught and face the consequences. Tax avoidance is structuring your affairs so that you pay the least.

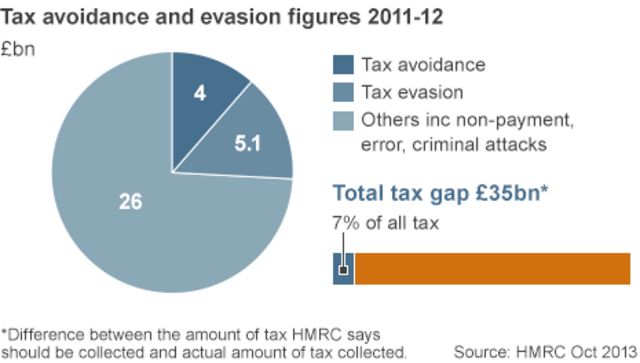

Tax evasion occurs when someone fails to disclose their taxable income or gains to the HMRC. It often involves contrived. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law. 01442 795 100 Existing clients. Recently HMRC were given the power to name tax avoidance schemes for the first time as part of its Tax Avoidance Dont Get Caught Out campaign.

HMRC is cracking down on evasion both domestically and offshore. Tax evasion means concealing income or information from the HMRC and its illegal. Tax avoidance involves bending the rules of the tax system to gain a tax advantage that parliament never intended.

Call 01442 795 100 Call Me. 28 This government has made significant investments in HMRC to tackle evasion. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two reports one.

DAC6 is a European regulation aimed at tackling tax avoidance and tax evasion strengthening tax transparency and improving information sharing between EU Member States. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. Of course sometimes it can be difficult to distinguish between tax avoidance vs tax evasion and some individuals and businesses can end up on the wrong side of the law as a result.

HMRC define a tax avoidance scheme in the following way. Many tax avoidance schemes devised by accountants and marketed towards the wealthy have been heavily criticised leading to HM Revenue Customs HMRC shutting them down arguing that they amount to tax evasion. Here we take a look at the difference between tax avoidance and tax evasion.

In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. We are hitting tax avoidance and tax evasion harder than ever before.

The Charity Commission Is To Focus On Compliance By Charity Legal Obligations Rigour Which It Holds Charities Accounting Services Wales England Sample Resume

Uk Officials Cracking Down On Tax Cheats Don T Mess With Taxes

What Is Tax Avoidance Taxwatch

Tax Evasion Hmrc Pays Millions To Those Reporting Suspected Tax Fraud

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

What Is Tax Avoidance Differences Between Tax Avoidance Tax Evasion

Tax Evasion Prosecutions Double After Surge In Small Time Offenders Tax Avoidance The Guardian

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Avoidance What Are The Rules Bbc News

Hmrc Confirms Fics Are Not Tax Avoidance Vehicles Ftadviser Com

Tax Evasion Or Tax Avoidance What S The Difference The Week Uk

Collapse In New Tax Probes As Hmrc Focused On Pandemic Policies Financial Times

Mac On The Row Over Whether Payments In Cash Are Immoral Morally Wrong Cash Home Decor Decals

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube